Having Trouble Affording A Home in 2023? – Here Are Options That Can Help

Whether you are currently renting a home, paying a mortgage or are looking to buy a new home, finding and keeping reliable housing can be a tough task. Some of us are held back by low credit scores that don’t let us qualify for a loan, some live in expensive housing markets and for others just affordable rent can be hard.

Thankfully, there are helpful programs and resources available that can help anyone afford the stable housing they deserve. Whether you’re looking to rent a 1 bedroom apartment or buy a 4 bedroom home, we have all the information you need to succeed in the housing market – especially in 2023!

Help for Renters

If you are low-income there are rental assistance programs provided by the government that can help you find a home and keep it, without constantly having to worry about paying overpriced rent or securing a safe place to live.

Section 8 Housing

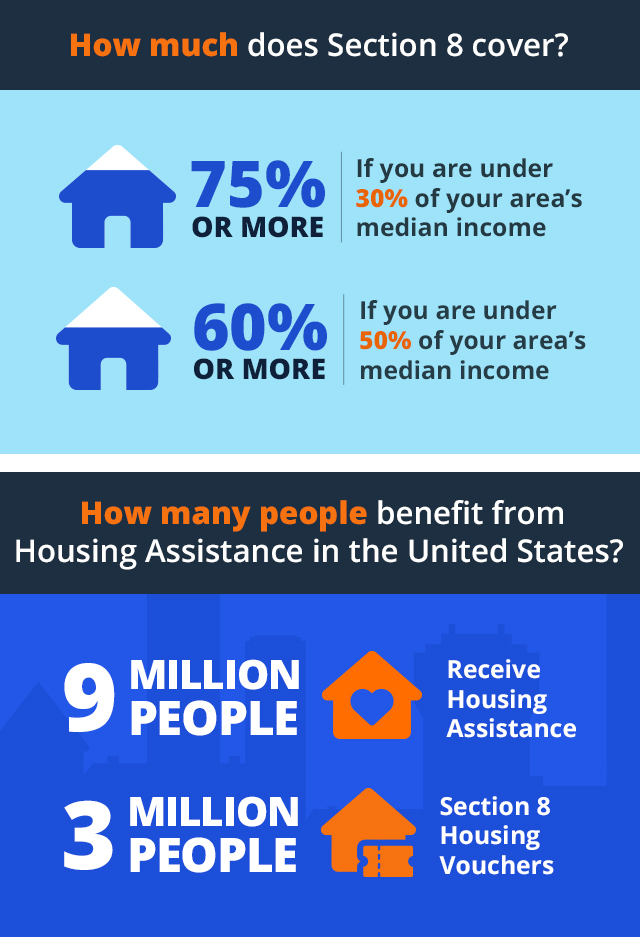

Section 8 housing, now known as the Housing Choice Voucher Program, helps low-income families find safe and sanitary housing that they can afford. Families can choose between apartments, townhomes or single-family houses that are eligible for the program. You can see what units are available in your area, by contacting your local Public Housing Agency.

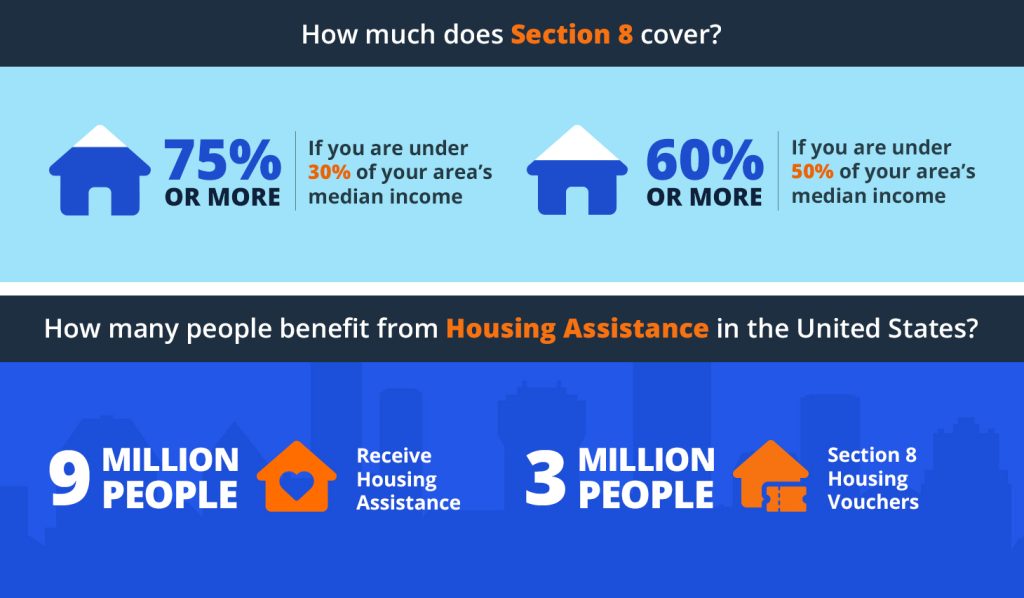

Section 8 covers some or all rental costs depending on your financial situation, so it can be a real lifesaver if you’re experiencing a lot of financial hardships. On average, those who qualify for Section 8 housing only pay 30 to 40% of their income on rent a month, and some pay even less.

HUD Housing

HUD Housing, also known as public housing or affordable housing, is a service provided by the US Department of Housing and Urban development. This program allows low-income and at-risk individuals to live in housing units owned and subsidized by the federal government.

This can really help struggling families get back on their feet and improve their financial situation. To qualify for public housing, your annual gross income must be 80% of the medium income limit in your immediate area or lower. You may also qualify if you are elderly or disabled.

You can get more info on HUD Housing, here.

Help for Buyers

FHA Loans

Federal Housing Authority Loans (FHA Loans), are loans provided by the federal government to help low-income families afford a home. FHA loans are also available for those who have low credit scores and may not qualify for other types of home loans.

If you want to but a small downpayment of just 3.5% on a home, you can get an FHA loan with a credit score of 580 or higher, and if you can put 10% down on a home, you can have a credit score as low as 500.

SEARCH FOR FHA LOAN LENDERS

Learn about different lending options and how you can secure a home loan today!

These types of loans can really help you if you’re in a home-buying pinch, but they do come with a few drawbacks like their very high interest rates. If you are able to manage your mortgage and the interest payments well, however, you will be able to finance a home purchase even with low income or poor credit.

Another great feature is that FHA loans lock the original mortgage amount in your purchase agreement. This means your mortgage will always stay the same throughout the duration of your loan, which is pretty amazing.

The Federal Housing Authority also provides other helpful housing assistance programs such as:

- The Home Affordable Unemployment Program – helps you reduce or suspend your mortgage payments for up to a year if you are unemployed.

- FHA Streamline Refinancing – helps you get better terms on your mortgage by locking the amount you refinance for so your new mortgage payment never changes.

- HUD Home Assistance Programs – helps you cover your down payment, closing costs, interest or principal depending on the programs available in your area.

To learn more about FHA loans and other housing assistance programs, click here.

First-Time Homebuyer Grants

Buying a new home can be complicated, not to mention expensive, but first time homebuyers have a bit of an advantage. First-time buyers can:

- Get grants to help pay for a down payment.

- Get lower interest rates on home loans.

- Get tax breaks.

Another benefit first time homebuyers can get is a government-backed loan. Lenders are more likely to give you a loan if you qualify as a first-time homebuyer because the government will pay if the borrower defaults on their payment. To qualify as a first-time homebuyer is pretty easy. You just need to be buying your first home either by yourself or jointly with a partner.

Tip

Each state also has its own programs to help first-time buyers secure a home, so it’s also recommended to do your own research to find the specific types of programs your state offers.

With all these first time homebuyer programs at your fingertips, you can find the home of your dreams and not be afraid of how you’re going to be able to afford it.

Help for Homeowners

Refinancing

If your mortgage is getting too expensive for you, you may want to try refinancing. Because refinancing is a completely new mortgage agreement, some of you might be worried that refinancing can hurt your credit. But there’s no need to worry. Refinancing your mortgage will slightly lower your credit score initially, but it will bounce back in a few months and actually help improve it over time since you will have less debt under your name.

Tip

Refinancing your mortgage can help you negotiate better terms, like lowering your monthly payments and lowering the interest rate on your loan.

Refinancing can really improve your financial situation and help you afford a mortgage more comfortably if done right and it is most definitely worth it. There are also refinancing possibilities for those with bad credit scores, so there is an options available for everyone.

LIHEAP

If you’re struggling to keep up with your monthly utility payments, the Low Income Home Energy Assistance Program, LIHEAP for short, may be right for you. If you qualify for LIHEAP, you can get help paying for electricity, water and all your other utility needs to make your home more affordable.

This can take a huge burden off your shoulders and make it easier for you to focus on paying your mortgage and other necessities, and maybe even a little extra to treat yourself later.

Other Housing Options

Even with all the housing assistance options we’ve already gone over, there are still even more to cover! We won’t bore you with every single one, but here are a few other programs that may be able to help you afford a home or rent.

Senior Housing Assistance

Senior housing is just what it sounds like. You qualify for this program if you are over 55 years of age and can no longer afford to live alone. Senior housing assistance is reserved for low-income seniors, but other restrictions may apply depending on the community you’re interested in living in and any other requirements set by your state.

Either way, these are usually comfortable accommodations geared toward making your later years a bit more comfortable.

Veteran Housing Assistance

If you’re a veteran or the spouse of a veteran, you are eligible for housing assistance through the Department of Veteran Affairs (VA). This means you can get a VA home loan to help purchase a new home for zero money down!

On top of that, the VA will also guarantee your home loan even if you have poor credit or fall into bankruptcy, making it more appealing for lenders to accept your offer.

Tip

You can also use a VA home loan to refinance your existing mortgage.

Rent to Own

Renting to own is one of the best ways to build equity in your home without having to struggle with a high-interest loan or risk investing large amounts of money all at once. When you rent to own, a portion of your monthly rent will go towards the eventual purchase of that property.

Rent-to-own homes also have a set purchase price, which means that the amount you agreed upon with the seller at the beginning of the deal will stay the same throughout the entire process. So even if the market value suddenly spikes, the original purchase price will not change.

Find Rent to Own Information

Get important information on renting to own and discover the perfect fit for you.

Whether you want to purchase a brand new home, need help paying rent or struggling to find an affordable place to live, there are dozens of programs and services available to help you get started. Take your time and review the resources we have provided so that you can make the best decision for yourself and your family.

Hopefully with a little luck, you’ll end up with the home you’ve always wanted.

By Admin –